BudgetInMind is a software designed to help you manage you accounting. To do this, you will need to enter your income and expenses into specific accounts so that reporting and analyzing is made easy for you. Before you start, we recommend that you read the following section that will give an overview of accounting principles and describe how BudgetInMind implement them.

An account is like an envelope containing all the the transactions of a given type. For instance, you can have a Clothing account that tracks your clothing expenses. Everytime you buy a cloth, you will add the amount to this envelope. You can also have a Bank account that will track all the inflows and outflows on that account.

BudgetInMind uses the double-entry accounting system, as used in Companies. This means that everytime you alter an account, another one must be altered too. For instance, if you buy food, you need to increase the Food account by the amount you paid. On the other side, you need to decrease your Bank account by that same amount.

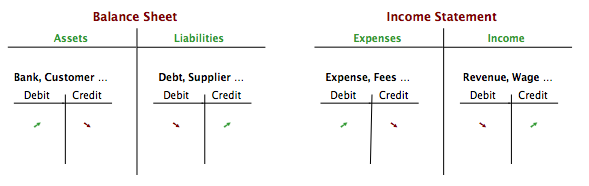

You will also see a lot the terms Debit and Credit in accounting. These terms regularly confuse people as we tend to describe them as decrease and increase, but it is not the case necessarily. Think of an account as a box with two columns, one that will record increases to the account (inflow) and the other a decreases (outflow). We call this a "T" account (from the shape of it). By convention, the left column is called Debit, and the right column Credit.

Sometimes, an account records it's increases (inflow) in the Debit column, sometimes in the Credit column. Generally, in each operation, one account will be Credited and the other one Debited.

It is fairly straightforward to understand how each account work. Always pictures your account as this "T" box and place that box either as an Asset, a Liability, an Expense or an Income. Then the rule is simple. Asset & Expense accounts mark their increases in the Debit column, Liabilities and Income accounts mark their increases in the Credit column.

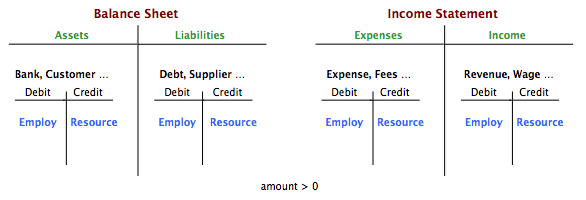

Warning: This is the reason why every account has an Increase on Credit property that you can alter. However, you should not alter the default BudgetInMind sets, since you now understand that it would revert all the operations on that account.

We tend to describe any transaction by having a resource account and an employment account. You use your resource account to pay for the employment. Again, the rule is simple, if the transaction amount is positive, the Employment account will be Debited of that amount and the Resource account will be Credited of that amount. It is the reverse if the amount is negative (for instance when you return a purchase to your dealer/supplier).

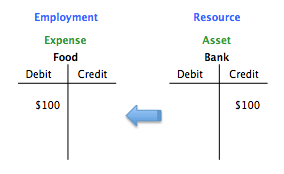

In the above example, we use our Bank account as a Resource to buy food, our Employ account. As such, we write $100 to the Debit column of our Food account. Since the Food account is an Expense account, increases are written in the Debit column. This is correct, you have indeed increased the amount of money you spent on food by $100.

Conversely, we write $100 to the Credit column of our Bank account (it is the Ressource). Since the Bank account is an asset, decreases are written in the Credit column. Again, this is correct, since we have indeed decreased our bank balance by $100 to buy the food.

While this seems complicated at first sight, it is in fact fairly simple, considering that most of your transactions are of the same kind. When you want to enter your accounts, we recommend that you picture what you are trying to achieve using a simple question. This way, you'll find >95% of the time the accounts you need for the transaction.

For instance, when you need to record an expense, ask your self this simple question: I'm buying what?, to whom? and pay using?.

- The what is called your employment account: What you employ your money for.

- The whom is your tier account: From whom you purchased the goods.

- The using is your resource account: The source of the money you used to purchase the goods.

The same type of question exist for income too: I am paid where?, from whom? for what?.

- The where is called your employment account: Where the money is going. You employ your time to refill your bank account.

- The whom is your tier account: whom you received the money from.

- The what is your resource account: The income account representing your work in your Company.

When you enter your accounts, you will most often find the right accounts to ventilate by answering the above questions or a similar one.

With these 2 examples, you can enter ~ 80% of your entries always the same way.

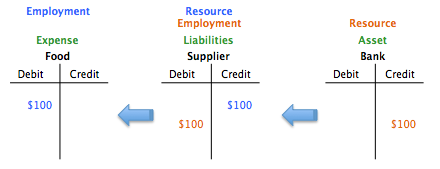

Since most of the time, you need 3 types of accounts to ventilate any transaction, BudgetInMind will natively support transaction entries with 3 different accounts in one line, to accelerate data entry.

Again, just say out loud what you are trying to achieve: I buy food (my Employment account) from my supplier (my Resource account). I now have a debt against my supplier. I will therefore reimburse my supplier (my Employment account) by paying with my debit card (my Resource account). BudgetInMind allows you to record these 2 transactions in only one book entry by specifying the food as your Employment account, the supplier as your Tier account and the bank as your Resource account.